what percent is taken out of paycheck for taxes in massachusetts

It is not a substitute for the advice of an accountant or other tax professional. What is the average percentage of money taken out for taxes.

Massachusetts Income Tax Calculator Smartasset

Everything You Need To Know About Taxes This Year Rich Dad Poor Dad Author Robert Kiyosaki.

. Massachusetts is a flat tax state that charges a tax rate of 500. That goes for both earned income wages salary commissions and unearned income interest and dividends. That 14 is called your effective tax.

If I make 32770. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Per year single 1 exemption what is my tax percentage taken out weekly.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Massachusetts residents only. MA taxes ordinary income at a flat rate of 53 however your withholding may be at a rate that is lower then this amount depending on the number of exemptions you claim on Form M-4. Note that you can claim a tax credit of up to 54 for paying your Massachusetts state unemployment taxes in full and on time each quarter which means that youll effectively be paying only 06 on your FUTA tax.

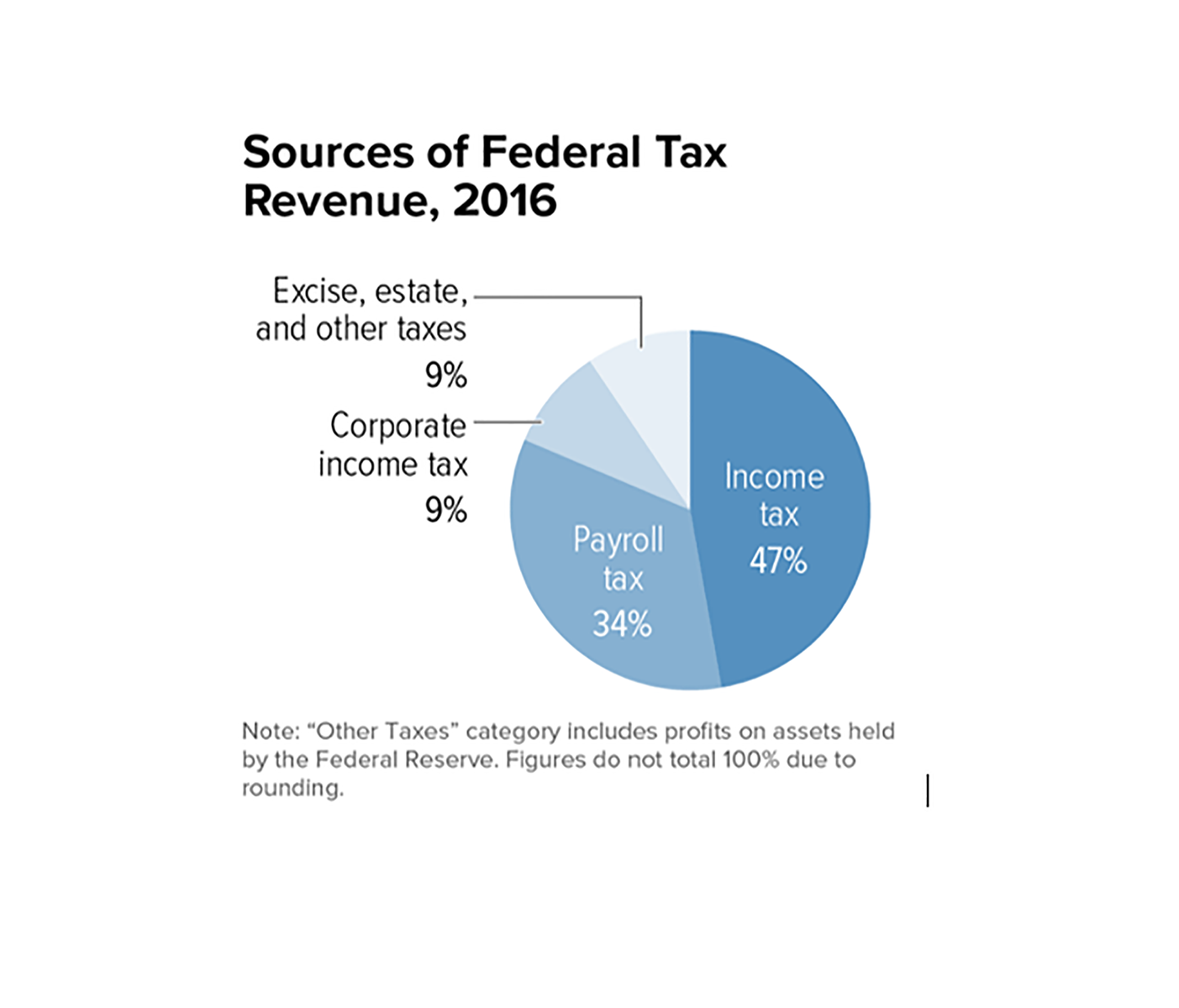

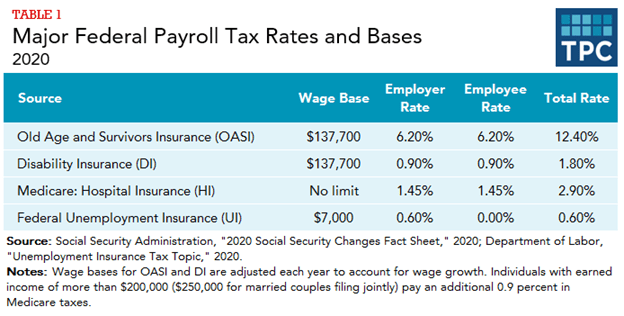

The total Social Security and Medicare taxes withheld. What are the tax percentages 2020. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket.

No Massachusetts cities charge their own local income tax. That goes for both earned income wages salary commissions and unearned income interest and dividends. Up to 32 cash back The tax rate is 6 of the first 7000 of taxable income an employee earns annually.

Although Massachusetts still levies a 625 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more. If you increase your contributions your paychecks will get smaller. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. It is not a substitute for the advice of an accountant or other tax professional.

Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4. What percentage is taken out of paycheck. What percentage does mass take out for taxes.

Divide this number by the gross pay to determine the percentage of taxes taken out of a. You must include winnings from the Massachusetts state lottery and non-Massachusetts lotteries in your Massachusetts gross income. This is because the 53 flat tax rate is applied against your taxable income which is equal to your.

However making pre-tax contributions will also decrease the. The amount of money you earn during your pay period when viewed with your filing status determines your income bracket and associated federal income tax rate. For unemployment insurance information call 617 626-5075.

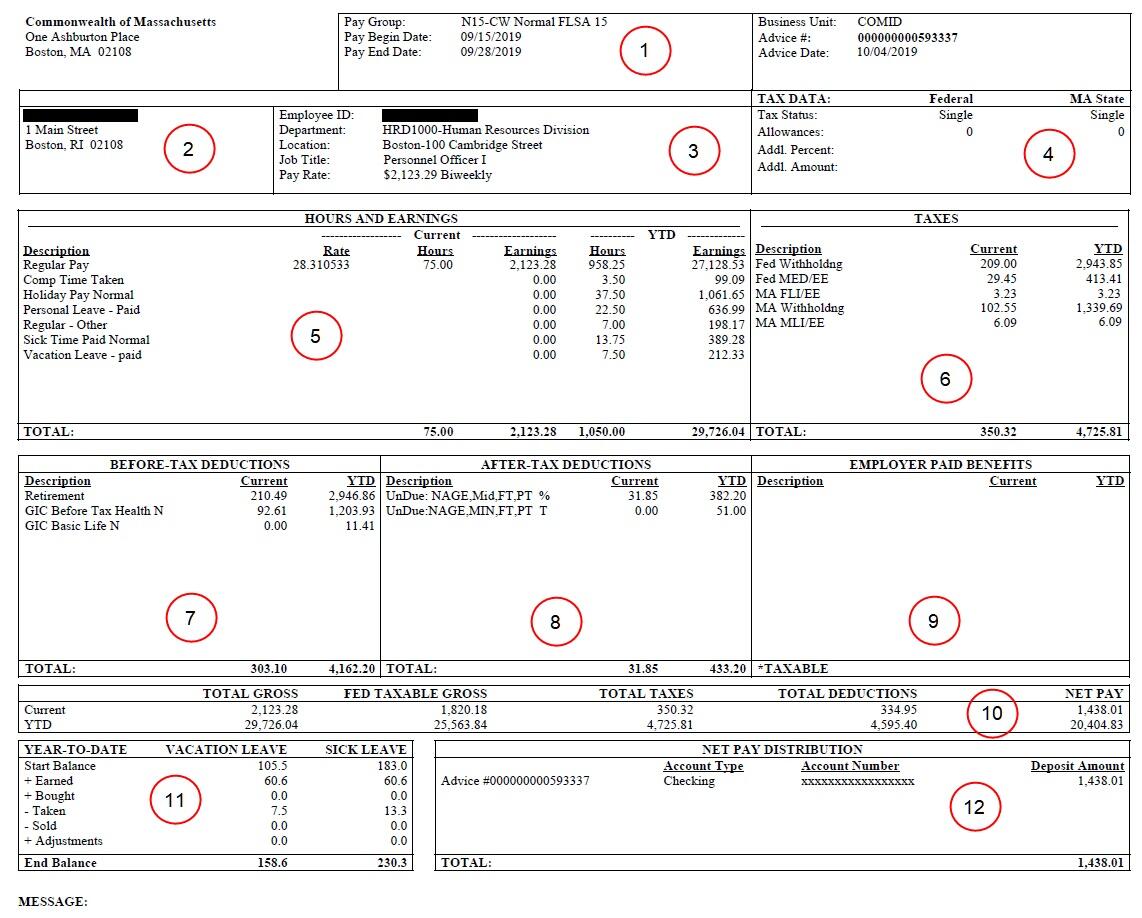

Is mass tax exempt. Where Do Americans Get Their Financial Advice. The amount of federal and Massachusetts income tax withheld for the prior year.

My pay is 63020 per weekWhat is my weekly state tax deduction percentage. A 2020 or later W4 is required for all new employees. Your employer will deduct 53 of your wages for Massachusetts income tax.

Massachusetts Bonus Tax Aggregate Calculator Change state This Massachusetts bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. You Should Never Say I Cant Afford That. Massachusetts Salary Paycheck Calculator.

Contacting the Department of Unemployment Assistance to fulfill obligations for state employment security taxes. For 2022 tax brackets visit this page from the IRS. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

Amount taken out of an average biweekly paycheck. 500 Overview of Massachusetts Taxes Massachusetts is a flat tax state that charges a tax rate of 500. How much state tax will come out of a 552733 pension pay out.

Switch to Massachusetts hourly calculator. Based on your pay rate and the W-4 you filled out they will deduct about 28 for the Federal Government plus SSIC. The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim.

The average amount taken out is 15 or more for deductions including social security. The average single American contributed 298 of their earnings to three taxes in 2019income taxes Medicare and Social Security. Overview of Massachusetts Taxes.

If you win more than 600 from the Massachusetts lottery andor wagering you will be taxed. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. Take-home pay is the net amount of income received after the deduction of taxes benefits and voluntary contributions from a paycheck. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Massachusetts residents only.

The average income tax rate for all Americans was 146 in 2017 according to the Tax Foundations method of calculation.

Massachusetts Paycheck Calculator Adp

Massachusetts Income Tax H R Block

Massachusetts Paycheck Calculator Smartasset

Here S How Much Money You Take Home From A 75 000 Salary

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Massachusetts Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

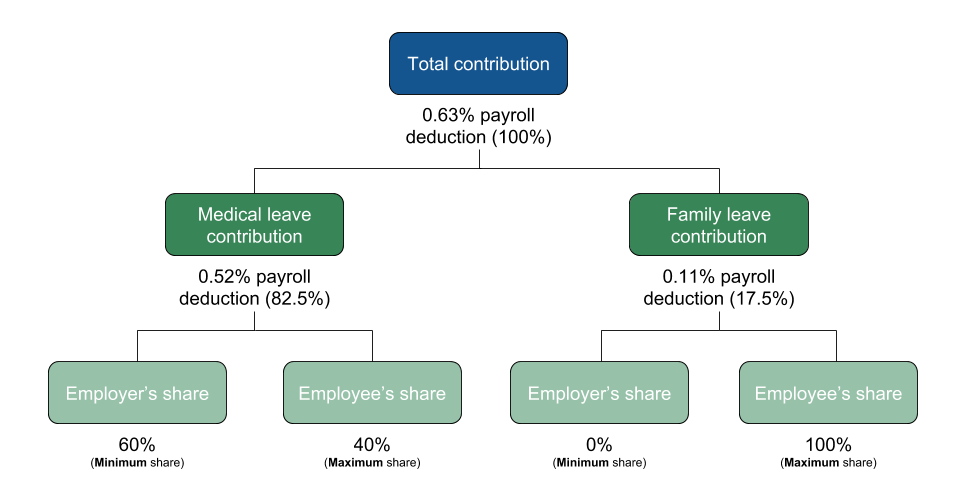

Massachusetts Announces Contribution Rates Effective July 1 For Paid Family Leave

Payroll For North America Updates State Paid Family And Medical Leave Quest Oracle Community

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

2022 Federal State Payroll Tax Rates For Employers

Learn More About The Massachusetts State Tax Rate H R Block

New Tax Law Take Home Pay Calculator For 75 000 Salary

Massachusetts State 2022 Taxes Forbes Advisor

Here S How Much Money You Take Home From A 75 000 Salary

Tax Withholding For Pensions And Social Security Sensible Money

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center